The earnings calendar is an essential tool for investors, traders, and analysts as it provides information about the financial performance of publicly traded companies. In this article, we will discuss the earnings calendar, its importance, and how to use it to make informed investment decisions.

Table of Contents

What is an earnings calendar?

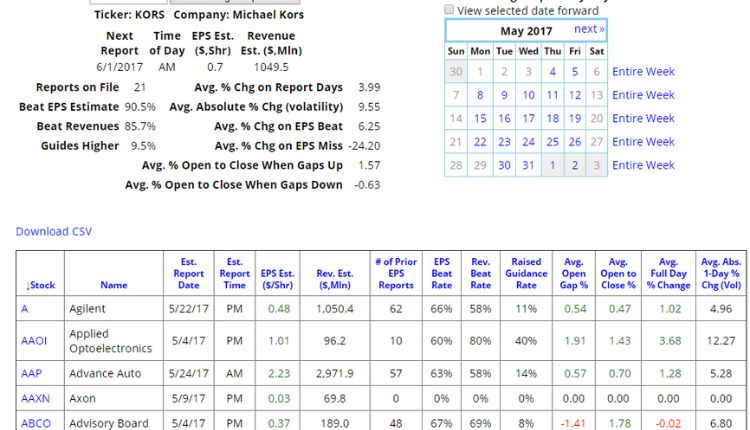

An earnings calendar is a schedule of dates on which publicly traded companies release their quarterly earnings reports. These reports contain information about the company’s revenue, net income, earnings per share, and other financial metrics. The earnings calendar is typically updated in real-time, making it an essential resource for investors, traders, and analysts.

Why is the earnings calendar important?

The earnings calendar is an important tool for investors, traders, and analysts because it provides insights into the financial health of a company. By tracking the earnings release dates of companies, investors can plan their investment strategy accordingly. For example, if a company is expected to report strong earnings, its stock price may rise, providing an opportunity for investors to sell at a profit. On the other hand, if a company is expected to report weak earnings, its stock price may fall, presenting a buying opportunity for investors.

How to use the earnings calendar?

To use the earnings calendar, investors should first identify the companies they are interested in and their earnings release dates. There are several sources of earnings calendar information, including financial news websites, investment research firms, and brokerage platforms. Once investors have identified the companies and their earnings release dates, they can prepare for the release by analyzing the company’s financials and market trends.

Investors should also pay attention to the consensus earnings estimate, which is the average of all the analysts’ earnings estimates for the company. If a company beats the consensus earnings estimate, it may be a positive sign for the company’s future performance. Conversely, if a company misses the consensus earnings estimate, it may indicate that the company is facing challenges that could affect its future growth.

FAQs:

Q: Can the earnings calendar be used to predict stock prices? A: The earnings calendar can provide insights into a company’s financial health, which can affect its stock price. However, it is important to note that many other factors, such as market trends and economic conditions, can also influence stock prices.

Q: How often is the earnings calendar updated? A: The earnings calendar is typically updated in real-time as companies announce their earnings release dates. However, some companies may change their earnings release dates, which can affect the accuracy of the calendar.

Q: Is the earnings calendar only useful for short-term investors? A: No, the earnings calendar can be useful for both short-term and long-term investors. Short-term investors may use the calendar to take advantage of short-term stock price movements, while long-term investors may use it to identify companies with strong financial performance and growth potential.

Conclusion:

The earnings calendar is an essential tool for investors, traders, and analysts as it provides insights into the financial health of publicly traded companies. By tracking earnings release dates and analyzing financial metrics, investors can make informed investment decisions and capitalize on market opportunities. However, it is important to remember that the earnings calendar is just one piece of information and should be used in conjunction with other market analysis tools